RBC Term Life Insurance

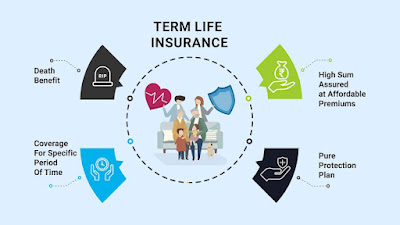

Having a term insurance plan is one of the most important financial decisions. As you can see in this article, we will look at the many benefits of term insurance. And how you can extract maximum value from this essential protection instrument. Let's get started.

Type Of Term Insurance:

- rbc term life insurance

- td term life insurance

- pnb met life term plan

- canara hsbc iselect term plan

Benefit One-Term Insurance.

Benefit One-term insurance is one of the most affordable forms of insurance. Out there, to put that into perspective, we pay about 2% of the car's present value. As its premium in comparison. Term insurance plans are available at as low as 0.1 percent of the sum assured that's 20 times cheaper. than a car insurance premium.

Not only is term insurance. The least expensive insurance out there. But to add a cherry on top of the cake, most insurance companies on online platforms. Your term insurance premiums benefit.

Term Insurance ULIP Plans.

Term insurance plans that offer a much, much higher coverage as compared to traditional or ULIP plans. In traditional or unit-linked plans. The coverage offered is generally 7 to 10 times the premium you pay.

If you pay a yearly premium of 20,000 rupees. You can expect about 2 lakh rupees of sum assured. 2 lakhs of sum assured is too low coverage and might cover. only 3 to 5 months of your family's expenses.

You Can Also Know About:

- Best term life insurance no medical exam.

- Term life insurance quotes no medical exam.

- No exam life insurance.

- Term life insurance no medical exam.

- No health exam life insurance.

On the other hand term insurance plans of a much higher sum are assured. So that you can leave your family and dependents with enough money. So that they don't go through financial hardships in your absence. Let's put some numbers behind it on ETMONEY. The average sum assured of a term insurance policy is a little over one crore rupees.

Which comes to an average premium of 17,000 rupees. This one crore sum assured is about sixty times the sum assured. I would have received in regular traditional money-back endowment or ULIP plans, net-net term insurance plans offer high life insurance coverage. At very low premiums.

Pure Life Term Insurance: Term Life Insurance no Medical Exam

Number 3 term insurance plans are super simple to understand. Simplicity is one of the reasons for the growing popularity of term insurance plans. Term insurance plans are what Pure Life covers. Which focuses on offering your dependents the contracted sum assured in case you were to die. You simply need to ensure that you have been paying the premium properly for term insurance plans that offer immense tax benefits.

There are three types of tax benefits that term insurance plans offer. One benefits under Section 80C. Which allows an exemption for life insurance premiums of up to 1.5 lakh per annum to benefits. Under Section 10 (10) D which pertains to death or maturity benefits that are payable under the policy.

This section directs all insurance benefits payable to be fully exempt from taxes. Which means your beneficiaries will get the entire coverage. Upon your death no taxes will be deducted. 3 benefits under Section 80 D. Which allows an exemption. To that part of the premium that is paid for health-related coverages like critical illness riders. which can be added to a term insurance plan, remember tax laws change often.

No Exam Term Life Insuranceg

So it is wise to be on top of this and consult. Your tax advisor for greater details, benefit 5 the premiums of term insurance plans are locked for the duration of the plan. It is surprising how many consumers don't know this. But when you purchase a term insurance plan.

You are effectively locking in the premiums that you'll be paying this year. The next year and every other year until the end of the term plan, and this is where it becomes highly beneficial and smart of you. To start your term insurance plan as soon as possible

.jpg)

0 Comments